Get the Right Fit: Medicare Supplement Plans Near Me

Get the Right Fit: Medicare Supplement Plans Near Me

Blog Article

Just How Medicare Supplement Can Enhance Your Insurance Coverage Today

In today's complicated landscape of insurance coverage choices, the function of Medicare supplements stands apart as a crucial component in enhancing one's protection. As people navigate the complexities of health care strategies and seek extensive security, understanding the nuances of supplementary insurance policy ends up being significantly essential. With a concentrate on linking the voids left by traditional Medicare strategies, these additional choices offer a customized method to meeting particular demands. By checking out the advantages, protection alternatives, and cost considerations linked with Medicare supplements, individuals can make informed choices that not only bolster their insurance policy protection yet additionally supply a complacency for the future.

The Basics of Medicare Supplements

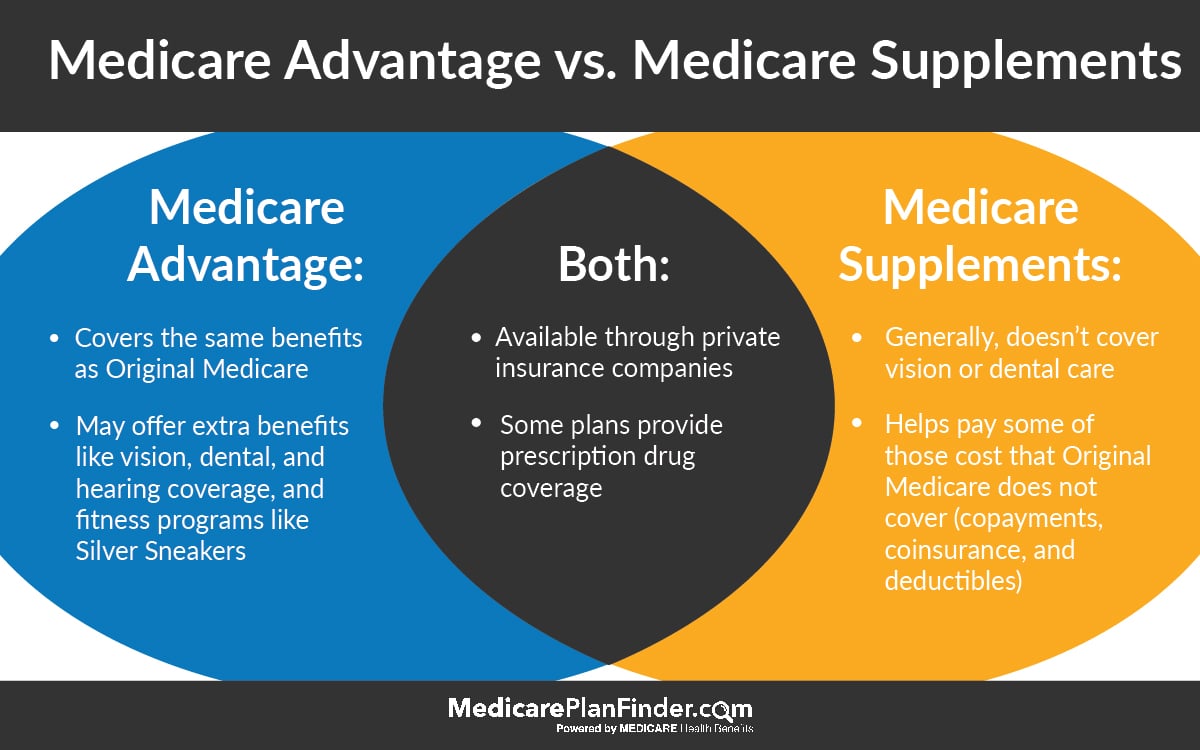

Medicare supplements, also recognized as Medigap plans, supply extra insurance coverage to load the voids left by original Medicare. These extra strategies are used by private insurance coverage companies and are created to cover expenses such as copayments, coinsurance, and deductibles that are not completely covered by Medicare Part A and Part B. It's necessary to keep in mind that Medigap strategies can not be made use of as standalone policies however work alongside initial Medicare.

One secret facet of Medicare supplements is that they are standard across the majority of states, offering the same fundamental benefits regardless of the insurance policy provider. There are ten various Medigap plans classified A with N, each offering a various level of coverage. Strategy F is one of the most detailed choices, covering almost all out-of-pocket prices, while other plans might supply extra minimal insurance coverage at a reduced premium.

Recognizing the fundamentals of Medicare supplements is crucial for people coming close to Medicare eligibility who wish to enhance their insurance policy protection and lower prospective economic problems related to healthcare costs.

Recognizing Insurance Coverage Options

When considering Medicare Supplement prepares, it is essential to understand the different insurance coverage options to make sure thorough insurance protection. Medicare Supplement prepares, likewise known as Medigap plans, are standardized across the majority of states and classified with letters from A to N, each offering differing degrees of protection - Medicare Supplement plans near me. In addition, some plans might provide coverage for solutions not included in Original Medicare, such as emergency situation care during international traveling.

Advantages of Supplemental Plans

Recognizing the significant benefits of additional plans can illuminate the value they offer individuals looking for enhanced healthcare insurance coverage. One key advantage of supplementary plans is the economic protection they give by helping to cover out-of-pocket prices that original Medicare does not completely pay for, such as deductibles, copayments, and coinsurance. This can result in substantial cost savings useful reference for insurance holders, specifically those that require constant clinical solutions or treatments. Furthermore, extra plans provide a wider variety of insurance coverage alternatives, consisting of access to health care service providers that might decline Medicare task. This adaptability can be crucial for individuals that have details medical care demands or prefer specific medical professionals or specialists. One more advantage of extra plans is the capability to take a trip with assurance, as some strategies offer coverage for emergency medical services while abroad. On the whole, his comment is here the benefits of additional plans contribute to a more extensive and customized method to medical care coverage, guaranteeing that individuals can obtain the treatment they require without encountering frustrating economic problems.

Price Factors To Consider and Cost Savings

Given the financial security and wider coverage choices given by supplemental plans, an important aspect to think about is the cost factors to consider and prospective cost savings they supply. While Medicare Supplement prepares need a month-to-month costs in enhancement to the standard Medicare Part B premium, the advantages of lowered out-of-pocket costs frequently exceed the included expense. When reviewing the expense of supplemental strategies, it is important to compare premiums, deductibles, copayments, and coinsurance across various plan kinds to establish the most economical alternative based upon private medical care requirements.

In addition, choosing a strategy that aligns with one's health and wellness and financial demands can result in considerable financial savings with time. By selecting a Medicare Supplement strategy that covers a higher percent of medical care costs, individuals can reduce unanticipated costs and spending plan a lot more effectively for healthcare. Furthermore, some extra plans use home price cuts or motivations for healthy habits, giving further chances for expense financial savings. Medicare Supplement plans near me. Eventually, purchasing a Medicare Supplement strategy can offer beneficial economic defense and satisfaction for beneficiaries seeking detailed coverage.

Making the Right Option

Selecting the most appropriate Medicare Supplement strategy demands mindful consideration of private medical care demands and financial scenarios. With pop over to these guys a range of strategies readily available, it is vital to assess aspects such as coverage options, costs, out-of-pocket expenses, provider networks, and general value. Understanding your present health and wellness status and any kind of anticipated clinical demands can guide you in choosing a plan that provides extensive protection for services you may call for. In addition, examining your spending plan restraints and contrasting premium prices amongst various strategies can aid ensure that you choose a plan that is budget friendly in the lengthy term.

Final Thought

Report this page